'Cos. need to forcefully sell insurance as it is no longer an option'

After the ferocious second wave of Covid-19 pandemic that swept India in April-May, insurance companies have settled about 80%, that is, over 15.39 lakh health claims exceeding an amount of ₹ 15,000 crore as of June 22, a top Insurance Regulatory and Development Authority of India (IRDAI) official said at an ASSOCHAM e-summit.

“Over 19.11 lakh covid health claims have been reported as on June 22 as far as medical insurance or hospitalisation is concerned. While in terms of death claims, which is handled by the life insurers, about 55,276 claims have been intimated and nearly 88%, 48,484 claims amounting to ₹3,593 crore has already been settled,” TL Alamelu, member (non-life), IRDA said inaugurating 13th global insurance e-summit and awards organised by ASSOCHAM.

The repudiated claim for health is just about 4% and in life, it is just about 0.66 per cent, which is negligible. These figures showcase the opportunity available for insurers, though Ayushman Bharat does cover health for many people, there are other schemes including specialised state schemes, but there are still many people who are not covered by insurance by any form, Alamelu said.

“Now we are grappling with the problem that most of these people have spent a good amount of their savings, it has even taken down many below the poverty line, they have gone into debts, sold up their assets, pledged their jewellery and have been pushed back to worst times,” she said.

“The industry has tremendous responsibility especially for a nation like India to offer protection and just not assume that people will not take insurance. There has to be aggressive probably, more sort of forcefully selling insurance because it is no longer an option,” she averred.

|

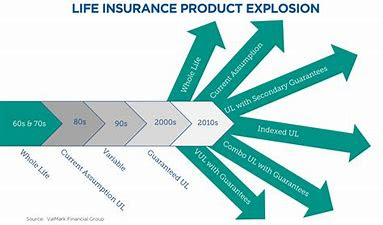

| How The Life Insurance Market Has Progressed Over The Decades |

Both the insurance industry and the regulator have worked together to design new policies to cater to the demands of the new and unprecedented situation. “We have also eased some processes and procedures to make it easier for servicing the policyholders,” she explained.

Complementing the insurance industry for ramping up its digital platform to cater to the increased online demand, she said, “Going forward, most of it will shift from office to online, its employees have worked as much and more from their homes to ensure uninterrupted services to the policyholders.”

About the micro, small and medium enterprises (MSMEs), she said, “There is a lot of focus on MSMEs, with the spate of recent initiatives by the government, insurance has a very important role to play here. The safety net offered by insurance keeps various industries thriving in a healthy manner. This spells greater employment, demand and consequent greater supply and the cycle goes on.”

The regulator has created standard products for MSMEs with policies like Bharat Laghu Udyam Suraksha, Bharat Sookshma Udyam Suraksha and others like Bharat Griha Raksha for householders, all these specifically cater to the middle class, lower middle class and industry should take this opportunity to ensure that everybody has this sort of insurance in their pocket, Alamelu noted.

On the insurance industry’s performance, she said that it grew extremely well to end the last financial year with combined life and non-life at a good nine per cent growth, while this year starting April-May, growth of 17% has been registered. On the growth prospects of the insurance industry in the next five years, she said that it can easily grow well at 40-50% to be extremely optimistic if things are settled down and otherwise it should grow at 25-30% as the world is there for them to take advantage.

|

| The Pyramid Of Savings & Insurance |

"In the new normal of technology, it is not just an important element for us to drive it out but is going to play a pivotal role in transforming the insurance businesses to make them more digital and customer-centric cutting across every sphere of customer experience - claims efficiency, fraud proofing etc,” said Mishra.

Vipin Anand, managing director, Life Insurance Corporation of India (LIC) and co-chairman, ASSOCHAM National Council for Insurance said that one of the critical needs for expansion of the insurance industry is that it is essentially a capital-intensive industry and for solvency-margin requirement, it is necessary that capital should come-in.

Highlighting the importance of insurance for a resilient economy, G Srinivasan, chairman, ASSOCHAM National Council for Insurance and director, National Insurance Academy said that the significance of the sector is being better appreciated now than before. “Hopefully, the new awareness on the need for insurance will make India a fully and adequately insured society at the earliest.”

Sandeep Ghosh, leader-financial services, EY India Consulting noted that the insurance sector continues to have tremendous potential in improving self-reliance, as its penetration and density have significant scope for improvement when compared to global peers.

.jpg)

Comments

Post a Comment